Insurance shouldn’t feel like reading a foreign language, yet many Product Disclosure Statements (PDS) run over 60 pages of legal jargon.

That confusion leaves many Australians unsure of what they’re actually paying for — and highlights why understanding your insurance policy is essential.

Why Policies Feel So Complicated

Each insurer uses slightly different definitions for “flood,” “storm,” or “accidental damage.” Even small wording differences can dramatically change what’s covered.

This confusion contributes to Australia’s growing insurance literacy gap, where households pay premiums without fully understanding their insurance policy or their rights

Breaking Down the Basics

- Sum Insured – The maximum amount your insurer will pay if your home is destroyed.

- Category Limits – Caps on certain item types (e.g., jewellery, electronics).

- Exclusions – Situations or damages your policy doesn’t cover.

- Excess – The amount you pay out-of-pocket when you claim.

- Specified Items – Valuables that must be individually listed to be fully insured.

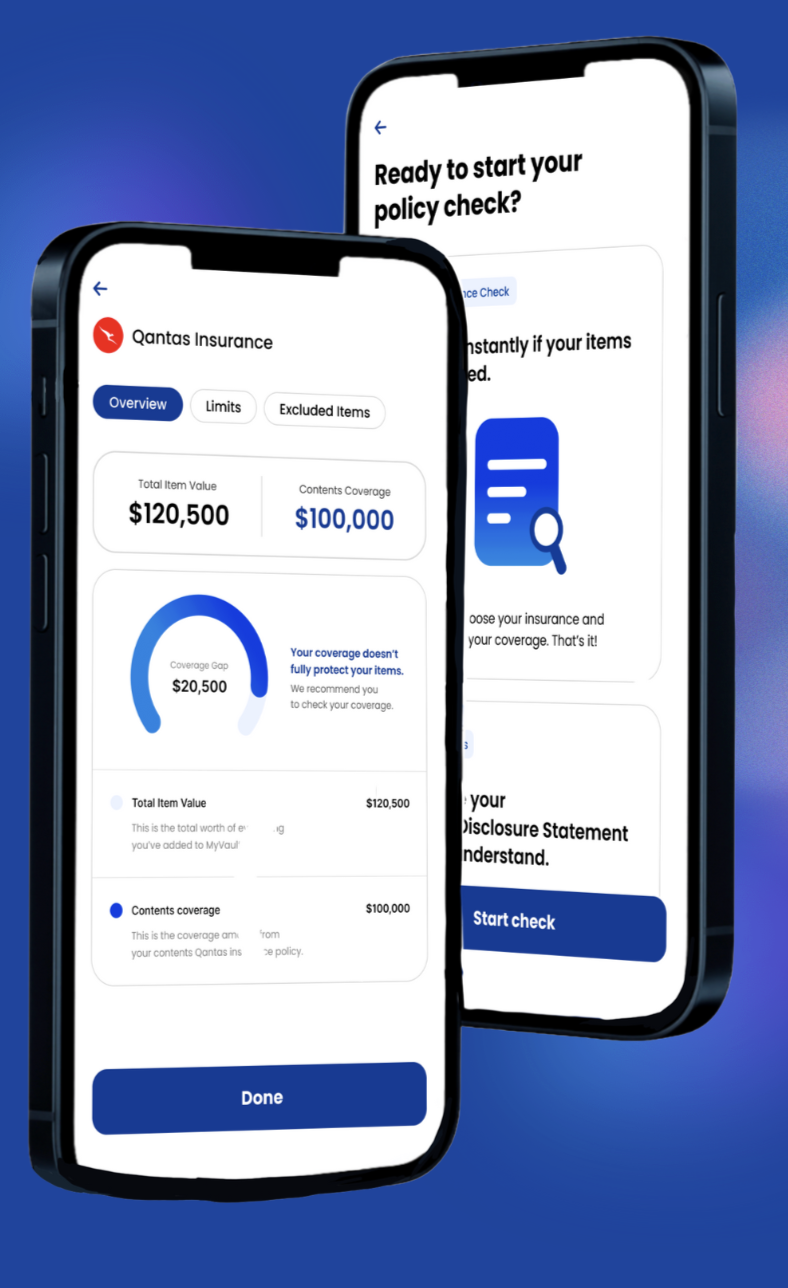

How myVal Simplifies the Process

With myVal, understanding your coverage is no longer guesswork:

- Upload your policy or PDS for a Policy Health Check.

- See plain-language explanations of exclusions and item limits.

- Receive recommendations for under- or over-insured categories.

- Store everything securely in one place — policy, receipts, and inventory.

When you know exactly what you’re covered for, you make smarter decisions and fewer costly mistakes.

Download myVal today to turn confusion into clarity and take charge of your insurance with confidence.

Leave a Reply